how to open tax file malaysia

Visit the official Inland Revenue Board of Malaysia website. Cukai Pendapatan Anda Terlebih Dahulu.

Pin By Uncle Lim On G Newspaper Ads Merry Christmas And Happy New Year Merry Christmas Happy New

Submit form CP204 within the first year.

. Click on ezHASiL. Get a PIN for e-Filing registration. Click on the borang pendaftaran online.

Login to e-Filing and complete first-time login. Make sure your email address is correct because LHDN will send a reference number to your email. Youll need to submit two copies of the Business Registration Certificate along with the LHDN registration forms.

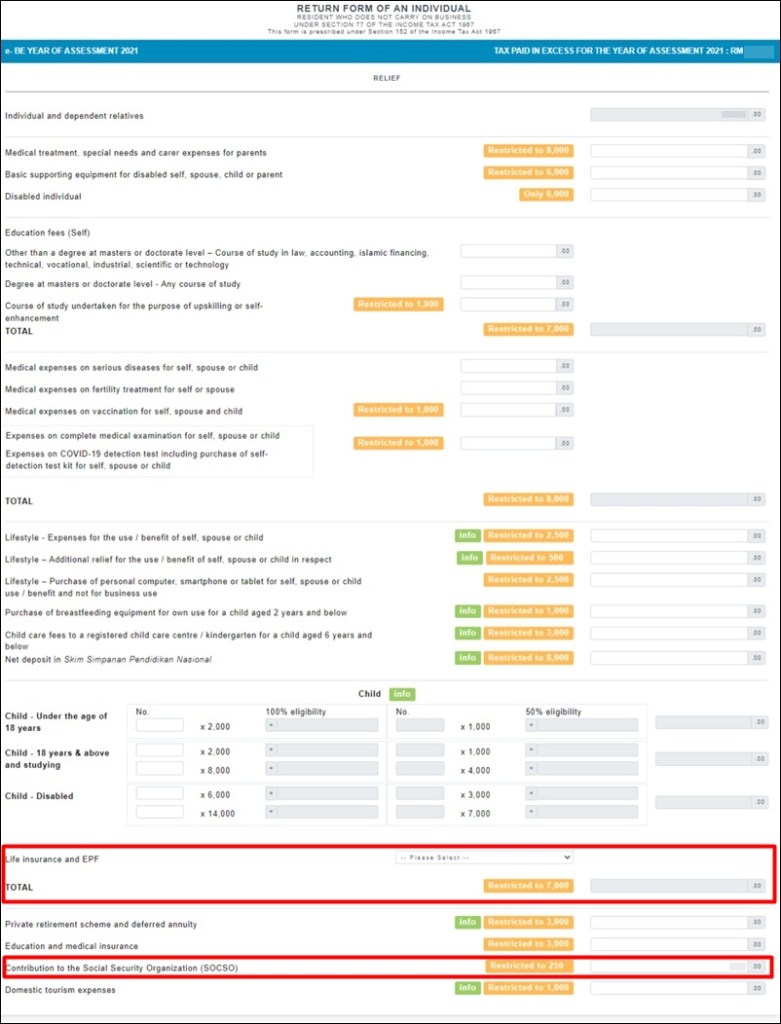

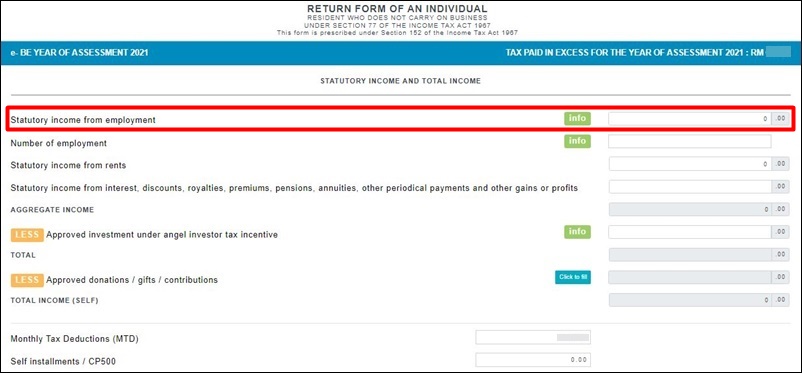

How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time. Online submissions of tax returns for 2021 will be accepted beginning March 1 the Inland Revenue Board LHDN said today. Individual who has income which is taxable.

To kickstart the process of registering as a taxpayer head on over to the LHDNs e-Daftar website. Taxpayers are advised to submit their. This can be done online or at their nearest office.

Click on Permohonan or Application depending on your chosen language. A video step-by-step guide to accompany our earlier post about how to file your personal income tax in Malaysia in 2019 as an expat or foreigner. Similar to the above you are also legally required to open a tax file at LHDN when you start your own company.

Go to e-filing website When you arrive at IRBs official website look for ezHASIL and click on it. Click on e-Daftar. Click on the borang pendaftaran online link.

At the various options available on the ezHASIL page choose myTax This will lead you to the main page of the the e. Heres how to go about it. Fill up the registration form.

We highlight the personal income tax rate for foreigners and expats how to get your income tax number from Lembaga Hasil Dalam Negeri LHDN or the Inland Revenue Board of Malaysia and. How Can I Open Income Tax Account In Malaysia. Passport number for non -Malaysian citizens Bank account name and number if applicable Marital status.

For 1st time login you need to click on the First Time Login in the ezHASil website fill up the document with all the required information and click on submit. Walk in to IRBM branch that handles your income tax file. Review all the information click Agree Submit button.

Click on the e-Daftar icon or link. Unregistered companies with IRBM. An employee who is subject to monthly tax deduction.

Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak dikenakan cukai untuk Tahun Taksiran 2021 selewat-lewatnya pada 15 Mei 2022 melalui e-Filing bagi mengelakkan sebarang penalti lewat kemuka Borang Nyata Cukai. Business address if applicable Personal email address. Browse to ezHASiL e-Filing website and click First Time Login.

To check whether an Income Tax Number has already been issued to you click on Semak No. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021. Submit income tax return Form C within 7 months from the end of the companys financial year.

Go through the instructions carefully. Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. Register with EPF Image via Dulu Lain Sekarang Lain.

1 Start off by registering. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Click on e-Filing PIN Number Application on the left and then click on.

Dimaklumkan bahawa pembayar cukai yang pertama kali. Click on the e-Daftar icon or link. Once you do this your e-Filing account digital certificate will be registered may proceed to complete the ITRF through ezHASiL e-Filing.

A business or company which has employees and fulfilling the criteria of registering employer tax. If youd like to retrieve it online head over to the LHDN Maklum Balas Pelanggan Customer Feedback website. Once you have completed and uploaded the required documents click Submit and LHDN will provide a Pin Number for you to review the application after 7 working days.

If this is your first time taking this income tax thing seriously youll need to register first. You must be wondering how to start filing income tax for the. Also remember to attach the income tax number and MyKad both front back.

Among the information that shall be updated are if any. Settle all unpaid taxes within 7 months from the end of the companys financial year. Once you receive the pin number you can proceed the login for every 1st time.

Fill up PIN Number and MyKad Number click Submit button. In a statement it said the submission of tax return forms through e-filing for Forms E BE B M BT MT P TF and TP can be made through the official HASiL portal. We have prepared a primer and a simplified step-by-step guide based on our own experiences to help you understand what you need to do and how to file your pe.

Theres a few steps to this but heres a quick breakdown. How To File Your Taxes For The First Time. Login for 1st time.

Go through the instructions carefully. Heres the process in brief for a new business. Microsoft Windows 81 service pack terkini Linux atau Macintosh.

Go to the official registration page and click on Borang Pendapatan Online. Fill in the required information. A businessperson with taxable income.

The following entities and accounting firms in Malaysia must file their taxes. Use e-Daftar and register as a taxpayer online. Pay tax instalments if a profit is forecasted in the coming year.

Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5.

Irs Can Audit Your Taxes Forever If You Miss A Key Form

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Difference Between Wire Transfer Swift And Ach Automated Clearing House Automation Transfer Money Transfer

Invoice Bill Sample Copy For Hotels Front Office Invoice Sample Invoice Template Word Invoice Template

City Jogging Bags Outdoor Luminous Sports Backpack With Usb Charge Port Not Include Power Students Anti Theft Laptop Backpack Gray With Usb Walmart Com School Bags For Boys School Bags School Backpacks

3d Model Of Bentley Continental Gt 2021 Bentley Continental Gt Bentley Continental Bentley

Festive Bonanza For Salaried Employees The Best Time To Buy Your Dream Toyota Harshatoyota Toyota Toyota Cars Good Things

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

How To Get A Tax Identification Number Tin Lawpadi

Form 2290 E Filing For Tax Professionals Irs Forms Irs Employer Identification Number

How To Register As A Taxpayer For The First Time In 2022

Irs Announces Filing Season Open Date It S Later Than Expected

Cryptocurrency And Bitcoin Tax Law 101 Cryptocurrency Bitcoin Online Networking

12gpu Stackable Open Air Mining Rig Frames Bitcoin Ethereum Miner Rack Us Seller Rigs Open Air Crypto Mining

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Ball State Logo University University Logo University Ball State University

Pin On Investopedia Money Management

Malaysian Tax Issues For Expats Activpayroll

Public Limited Company In Pune Public Limited Company Private Limited Company Limited Liability Partnership